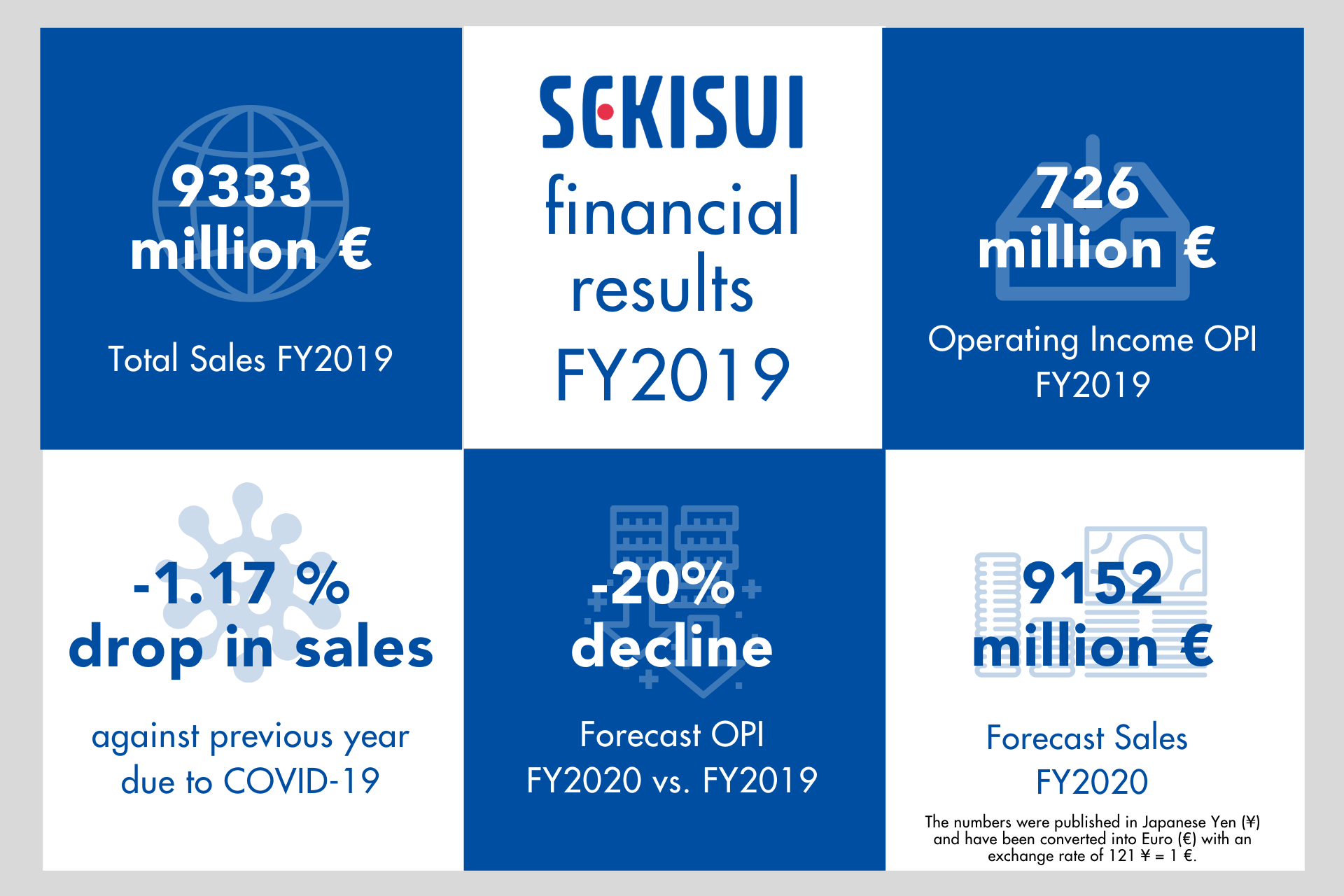

The SEKISUI CHEMICAL Group has recently announced the financial results of the past Fiscal Year. The numbers for 2019 follow the global market trend: due to the spread of COVID-19, sales and income of the company decreased. With a substantial drop in operations and sales as of February 2020, the forecast was not achieved. In FY2019 sales was 1129.3 billion ¥ (ca. 9333 million €). Facing further economic impacts of the pandemic, the financial plans for the Fiscal Year 2020 were updated.

The Fiscal Year 2019 ended with the negative consequences of COVID-19, which had Group-wide effects from February 2020 on. Sales were growing in the first half year of 2019, compared to the first half of 2018, but the positive trend ended in the second half of the year 2019 – with a sales difference of -2.6% compared to the second half of 2018.

Talking about concrete numbers for the Fiscal Year 2019

There was an overall sales decrease from 1142.7 billion ¥ in FY2018 to 1129.3 billion ¥ in FY2019 – which means a total decline of 13.4 billion ¥ (ca. 111 million €, from ca. 9444 million € in FY 2018 to ca. 9333 million € in FY 2019).

The main reason for the sales decrease is lower operation rates of customers in the automobile and transportation fields, which hit the High Performance Plastics Company (HPP) the hardest. HPP sales decreased -5.5% compared to the previous year due to COVID-19 (downturn in operations) and an already prolonged slump in the automobile market. The Housing Company was negatively influenced by delayed delivery of houses as well as the postponement of handovers due to delays in housing materials delivery. In the Medical Business, sales were lower than planned due to a decline in outpatient tests for lifestyle related diseases.

Single positive prospect: The Urban Infrastructure and Environmental Products Company (UIEP) steadily increased sales due to high-value-added product growth (prioritised products in Japan), setting a record high income as a company.

The operating income OPI fell from 95.7 billion ¥ (ca. 791 million €) in FY2018 to 87.8 billion ¥ (ca. 726 million €) in FY2019. The Group managed to control fixed costs, yet the OPI goal of 97 billion ¥ could not be realised. Braking factors: decreasing sales volumes, soft raw material prices, a substantial decline in profit due to the negative impact of foreign exchange, newly consolidated companies and COVID-19.

In Europe, total sales decreased from 61.3 billion ¥ (ca. 506 million €) in 2018 to 55.4 billion ¥ (ca. 458 million €) in 2019.

Perspective for 2020

The SEKISUI CHEMICAL Group will rise to the challenges of FY2020. The company is realistic and expects a further decrease in sales and a downturn at each level of profit due to COVID-19. Currently, the market conditions in Fiscal Year 2020 are expected to gradually recover beginning in June and return to normal in the second half of FY2020.

While steadily capturing postponed demand by keeping its supply chain running in anticipation of a recovery in demand, the SEKISUI CHEMICAL Group will continue to invest for growth. In order to be prepared for a recovery in demand in and after the second half of 2020, it will accelerate the supply chain-wide cost innovation, business structural reforms, and reduction in fixed costs excluding growth investment. For the SEKISUI CHEMICAL Group, there is one main goal: minimize the impact through self-help efforts, maintain and strengthen the systems to secure a recovery from the Fiscal Year 2019 as well as the first half of Fiscal Year 2020.

FY2020 adjustments

The initial sales plan for this year of 1186.6 billion ¥ (ca. 9807 million €) was adjusted to 1107.4 billion ¥ (ca. 9152 million €), according to the evaluation of the market situation. Instead of an operating income OPI of 98 billion ¥ (ca. 809 million €), the company set an OPI target of 70 billion ¥ (ca. 578 million €) for 2020. If the plan will meet reality, there will be an overall OPI decline of about 20% in 2020 towards 2019.

The SEKISUI CHEMICAL Group is facing challenging times with the reductions in the automobile business and smartphone production, lower demand for diagnostic agents for lifestyle-related illnesses, fewer visitors to housing exhibitions and delays in construction as a result of COVID-19. But the Group already made decisions to continuously strengthen the business base – for example by expanding sales for products that require fewer workers, by expanding the application scope of interlayer films for laminated glass in high-performance products and generating effects of new lines built in Europe, by supporting the airline industry in the US or by launching new products in the East Asian market.

For all detailed numbers, please have a look here.

General background information

The Japanese Fiscal Year (FY) lasts from 1 April to 31 March and therefore does not match with the regular calendar year. FY2019 describes the period from 1 April 2019 to 31 March 2020. The same principle applies for all other Fiscal Years.

SEKISUI CHEMICAL CO., LTD. discloses financial results in Japanese Yen (¥). However, for a better understanding the figures have been converted into Euro (€). Due to changing exchange rates this is just a rough calculation. This exchange rate is used: 121 ¥ = 1 €.

* Please note that the numbers cover all businesses of SEKISUI which are High Performance Plastics Company, Housing Company, Urban Infrastructure & Environmental Product Company and Medical Business.